BSBFIM502 Manage Payroll Online Tutoring

Manage Payroll

1. What are some security procedures to protect information and possible approaches for payroll information? List 5 different options and give a brief explanation for each.

Procedures below:

⦁ Physical Layout: The physical environment of the firm contributes a lot to the firm’s payroll confidentiality. The organization should make sure that the physical layout of the payroll department needs to be a bit separated from the rest of the office as it holds confidential payroll information. The firm needs to see that employees or customers walking inside the organization should not have ease of exposure to the verbal communication, computer screens or physical documentation of the department.

⦁ Limited Access Policy: There are policies to be set for who can access the physical location of the data and what would be the procedure for it, as employees might have queries about their payroll and they want to discuss with the payroll officer. It’s an employee’s right to approach the payroll department for queries but the information should be limited and employees should not have access to other colleague’s information. There should be strict supervision while the employee from any other department is in the payroll department.

⦁ Security of Electronic Media: Company’s databases are exposed to all sorts of data breaches and external attacks. The firm needs to use particular software are which are safely connected to the ERP of the organization with a firewall in the middle. Firewall is important to keep a barrier between Payroll and other departments electronically and to save against external attacks as well.

⦁ Outsider Inquiries: Payroll department is connected to internal and external both sorts of people. All the outsider inquiries received via online or physical approach shall be dealt according to safety measures. The companies are connected with multiple mortgage firms, banks, creditors etc so all of them should fulfil the basic requirement of security and pass through security fire wall. There are usually fake inquiries received with attachments of viruses intending for data attack so the firm needs to have registered Antivirus protection to deal with such inquiries (Dixon, et al,2004).

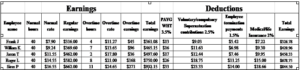

⦁ Information disposal: Information disposed in terms of documents or softcopies both are of vital importance. There should be electronic shredders provided to the payroll department to shred all sorts of information before dumping it to avoid incidents of dumpster diving. The softcopies of the data should be discarded with appropriate measures and their backup shall be maintained by IT departments.

2. Identify the key provisions of relevant legislation standards and codes that may affect payroll operations.? Please ensure you address taxation legislation, privacy legislation, anti-discrimination legislation & WHS legislation.

Below are the various legislation standards that may impact the payroll operations.

⦁ Constitutional Acts of Privacy:

⦁ How to treat personal details of a person, data access procedure and storage

⦁ Security of data

⦁ Access of the system

⦁ Modern Awards and Agreements of Enterprises:

⦁ Categorization of employees

⦁ Segregation of Wage rates, working hours and fines

⦁ Set Allowances, terms and conditions

⦁ Corporate reporting:

⦁ Annual reporting

⦁ Board member’s reporting

⦁ Human services departments:

⦁ Employment confirmation

⦁ Parental leaves(paid)

⦁ Children support

⦁ Taxation:

⦁ Weekly /Bi weekly/Monthly Taxes

⦁ Taxation of bonuses

⦁ PAYG Withholding

⦁ Instalment of BAS

⦁ Share plans of employees

⦁ Income from foreign sources

⦁ Yearly payment summaries

⦁ Anti-discrimination Act: Aimed at providing protection to all the people on basis on of ethnicity, race and national origin. Discrimination shall be avoided on basis of Equal Opportunity Act 1977 and the Act of Anti-Discrimination 1977(Leventhal, 2012).

⦁ WHS Legislation: In the light of WHS law all the organizations are bound to provide healthy and safe environment to their workers. The law is to assure that the level of risks is to be minimised in workplaces for worker’s safety. Firms are bound to pride fair and operative exemplification and cooperation to workers.

3. What procedures guarantee substantiation of claims for allowances?

⦁ Employees/Workers should submit sufficient proof in the form of softcopy or a document to particular department responsible for settling the claims.

⦁ The claims submitted by employees/workers will be verified by relevant payroll or other relevant department’s personnel.

⦁ The approval of claim or allowance issue/reimbursement shall be done by HOD.

⦁ Any sorts of substantiation in relation to the claims will follow the ethical code or firm and the law of country.

⦁ All the claims submitted would be reimbursed within 20 days of claim following complete procedure (Dixon, et al,2004).

⦁ All the proofs being submitted should be timely submitted within the recent duration of those claims.

⦁ The proof of claim documents submitted should be stamped or signed by the concerned points of expenditure.

4. As a manager, what control measures do you need to establish to safeguard organisation’s financial resources in accordance with legislative and organisational requirements?

⦁ Discuss the assigned monthly funds of the department with the subordinates

& guide them to follow accordingly.

⦁ Make the other interrelated departments follow the SOPs of my particular department.

⦁ Reviewing implication whistle blowing policy within the organization for reporting of an illegal/unethical activity which may harm the financial resources of the firm.

⦁ Discarding all the requests from any department/employee which clash with the company’s code of conduct or Country’s constitution.

⦁ Monitoring day to day departmental progress and its alignment with the financial resources (Ralston,2009).

⦁ Implementing measures to maintain security of confidentiality of Financial resources.

5. What are the payroll systems and statutory obligations to ensure compliance for the following

Workplace Relations Regulations 2006; Fair Works Act 2009; National Employment Standards; Superannuation Guarantee (Admin) Act 1992; Income Tax; Payroll Tax; Paying

Payroll Liabilities

The payroll systems need to comprise the required obligations. Below are the obligations that have to be followed payroll systems:

⦁ The payroll system should classify the employees

⦁ It should clearly mention the working hours

⦁ Rate of pay should be clearly stated

⦁ The per piece rate and bonuses should be mentioned

⦁ All the penalty rates and allowances to be disclosed to workers

⦁ The procedures to settle any dispute should be informed

⦁ The notice period for termination shall be informed to employees/workers

⦁ Number of public holidays and different forms of leaves shall be stated

⦁ Workplace rights of the employees/workers shall be protected (Mitchell & Bateman, 2004)

⦁ Employees shall have complete rights to involve in business activities

⦁ There shouldn’t be any sorts of undue influence or pressure in terms of business negotiations

⦁ Employees shall be protected against unlawful deductions and coercion

⦁ The payroll system should also consider parental leave and other related entitlements

⦁ There should be flexible operational arrangements for workers

⦁ The payroll system should follow all principles provided by superannuation as well to protect the future of employees when they retire.

⦁ The organization should make sure that all the employees and the firm itself are regularly contributing to the superannuation funds as per the defined percentages

6. How would you use nominated industrial awards, contracts and government legislation to calculate gross pay and annual salaries? Ensure you describe the type of employment contract e.g. AWAs, EAs etc in your explanation.

The act of workplace relations 1996 had introduced the federal relations system to a novel form of tool for the directive of employment association also called Australian Workplace Agreements (AWAs). AWA has allowed employees and employers to setup wages and other terms and conditions with flexibility. AWAs further allow them to agree on the provided arrangements and match with their individual preferences (Worthington,2001).

There are numerous variables to be considered while calculation of salaries and gross pay in the light of nominated industrial awards, contracts and government legislation, as listed below and not limited to:

Salary variables Values

⦁ Basic payment structure

⦁ The appropriate check in and check out time sheets

⦁ Alignment with sick and casual leaves

⦁ Overtime earned by workers

⦁ Set Penalty rates

⦁ Allowances

Deductions to be considered:

⦁ Superannuation tax

⦁ Payroll tax 4.85%

⦁ Medical levy of 2%(as on June 2019)

⦁ Fees of insurance 2%

⦁ Pay as you go (PAYG) 3.5%

The above variables shall be considered while calculating gross and annual salaries. Under the yearly pay the employers also need to adjust the annual leaves with the pay just in case the employee doesn’t want to avail annual leaves and wants to avail pay per leave against them so that factor will also be considered.

The set variables not only fall under the basic and important guidelines of AWAs but also need to fulfil the criterion of Workplace Relations Regulations 2006; Fair Works Act 2009; National Employment Standards; Superannuation Guarantee (Admin) Act 1992; Income Tax; Payroll Tax; Paying Payroll Liabilities which lay the foundation of protection of employee and employer rights.

7. As part of a manager’s role, you need to understand how to calculate statutory and voluntary deductions using government and employee documentation. Please ensure as part of your answer that you give a minimum of 4 example descriptions of deductions such as Medicare, HELP, Child Support etc.

⦁ Statutory deductions include elements of medical levi, Pay as you go (PAYG) and schemes for the Higher education contribution. Voluntary deductions include which an employee willingly wants to get deducted from his/her salary. There are a few examples of health insurance, retirement, dues of unions, deductions for salary advances, life insurance etc.

⦁ In life insurance plans employees have right to choose to have deductions from their pay-checks which will go forward to their insurance premiums so it depends on what policy they have availed (Whiteford,2010).

⦁ The deductions include Job related expenses including the union’s dues etc again these deductions differ from organization to organization.

⦁ The deduction may also include Garnishments where court may order the firm to recover employee’s unpaid debt from his/her paycheck.

⦁ HECS and Help repayments or other voluntary repayments made by a person or someone other than the employer are not tax deductable but can be deducted from paychecks for recovery.

Note: For complete reference of statutory and voluntary deductions please refer to question no 8

8. What do you need to consider when providing payroll data to payroll processor for calculation within designated timelines? You will need to include a brief explanation on each of the elements e.g. Prepare a payroll register; Key organisational timelines; Fringe benefits tax; Other payroll deadlines including ATO, TFN declaration, PAYG withholding; Employment termination payments; Employer superannuation contributions; and Business Activity statement (BAS)

Note: All the values and percentages applied are estimated

9. Expand on how you check the payroll and authorise salaries and wages for payment in accordance with organisational policy and procedures.

Pay rate verification

Being a payroll officer it is to be regularly checked that if the listed rates are correct or not. In a situation where companies have thousands of employees so it is difficult to keep logs of rates changes in the mind of a manager. So automated systems should be used to update the pay rates, a change made by a single team member of the payroll department shall generate notification to all the other team members informing them that the pay rate of certain employees has been modified.

Timesheet record

Regular time sheets shall be shared with the payroll officer through the biometric machines which are used to maintain all the punch and punch out record. As payroll is verified through the record of timesheets and any difference can lead to financial injustice to an employee or the company.

Internal software Maintain ERP Logs

In the authorization process of salaries and wages an organization should have a fine internal software or ERP to assist the payroll manager. The payroll manager should regularly make the required changes to the software and also keep a record of logs.

Pay confirmation for on job employees

A payroll manager needs to make sure that only active employees get the pay as in bigger companies where there are hundreds and thousands of employees so there might be a chance that pay is transferred to older employees who are not currently working in the firm. Hence there should be regular check of employee data so that only the active employees get the pay for their effort and company can be saved from any sorts of financial loss.

Payroll report and ledger checks

Payroll manager needs to assure that all the gross payroll earnings, deductions, WHT, Medical and other fringe benefits etc they all match to the general ledger records. Review is to be done for all sorts of suspicious larger or smaller amounts. All the accounting principles of GAAP need to be strictly followed (Krever & Sydney,2003).

Cross check of Bank Reconciliation and Payroll Accounts

All the totals be it in the bank reconciliation or the payroll accounts they all need to match each other. It is to be assured as per company policy that all the financial instruments e.g. cheques, pay orders etc. are cleared for the particular amounts that they were issued.

Tax submissions

In the process of salaries and payroll authorization it is to be regularly checked that all the particular taxes gathered from the employees are timely submitted to concerned taxation departments. The deadlines of all the taxation departments shall be met and the payroll manager should also see the day to day changes in the taxation rates.

10. Explain how and what the procedures are to reconcile total wages for pay period, check and correct irregularities and refer to designated persons for resolution. As part of your response, please ensure you include at least 3 different circumstances that could affect the organisation’s payroll.

The procedures to verify and reconcile payrolls need to be systematic in nature. The payroll manager should keep its team in loop so make them follow the payroll system in the light of company’s policies and the Country’s laws.

⦁ The payroll manger needs to perform regular check of the pay rates if they are being regularly updated/verified or not E.g. As by error pay rates of certain employees who have received increased may have been not updated in the system which might lead to clash between the organization and the employee due to transfer of a lesser salary to the employee’s account.

⦁ The payroll manager needs to assure that all the cheques are cleared form the financial institutions e.g. there might be a situation where the company has issued salary to its employees by cheques and some of the cheques are cleared but the others are not. The payroll manager if didn’t keep record of this incident so the salaries expense maybe mentioned on the company’s financial records but in the bank reconciliation statement the expense won’t be recorded due to the stoppage of cheques, on the other hand the employees would report this incident that they weren’t paid salaries on time. The resolution to this problem can be constant engagement with banks to ensure clearance of all cheques specially in the first 3 days of salary transfer (Woellner,et al.,2010).

⦁ Another case could of a change in the taxation rates e.g. there is a change in income tax rate of the country but the payroll officer has not noticed this policy and the monthly pay was issued with the deduction of the old rates so in such a case it would be a difficult situation for the payroll manager to justify his ignorance and not being updated with the changes in taxation policies. To avoid such a situation there should be a bi weekly or monthly review of all the tax rates being applied on employee salaries for regular update.

11. How do you deal with salary, wage and related enquiries in accordance with organisational policy and procedures? Please ensure you include an explanation on legislative requirements, methods of handling inquiries, communicating appropriately, the resources to handle inquiries and support from the ATO including the online tax calculator.

⦁ Receive inquiries via internal email or Employee portal

⦁ Maintain confidentiality of records via having close meetings in separately from the payroll department’s physical location

⦁ Prefer online communication as easy to maintain record

⦁ Introduce and train employees for usage of communication portal to easily address their concerns on the portal as in a company of hundreds of employees it would be difficult to maintain physical or telephonic contact with each one

⦁ The portal would be consisting of all the policies and procedures of the company mentioned for the employees to go through which may answer many of their queries

⦁ A separate section of FAQs would be mentioned on the online system where all the FAQs would be addressed.

⦁ To ease the pressure of queries and breakdown clarity to the employees the employees would also be having access to a non-editable version of their salary ledger so that they can easily understand the complex structures of taxes & other formulas (Slemrod,2010).

⦁ A systematic ERP would allow the payroll manager to review the progress of a salary related inquiry and its work in progress status.

⦁ A section of meeting scheduler would be providing in the ERP where employees who want to discuss their salary wage inquiries in person with the Payroll officer.

⦁ Set inquiry numbers and standardized durations for the resolution of each inquiry along with inquiry’s progress status.

12. How do you process declaration forms for new and existing employees in accordance with Australian Taxation Office requirements?

An employee declaration form would require an employee to fill all the basic personal, professional and taxation related details of himself. The declaration form would make the firm able to know about the background of the employee in terms of a professional and also as a citizen of the country.

The employers and employees are required to fill the following procedures to comply with Australian tax office requirements:

⦁ Employees are supposed to complete Tax file number declaration (TFN) which can be one through the ATO Online services. They are supposed to complete the form summary and then submit to back to the organization

⦁ The process further moves to the stage where the TFN form has to be submitted to ATO within 14 days after the signature of the form either by the employee or the employer.

⦁ The procedure would further move to check if the employees have a superannuation guarantee or not, if they do have it then the employee is supposed to complete the pre filled form of Standard Choice.

⦁ Employers would be assigning the Australian Business number (ABN) to employees, Type of employment (permanent, casual, part time) etc

⦁ As per requirements of ATO being an employer we would be keeping all records of the employees (Baron & McCaffery,2003)

⦁ In case of provision of fringe benefits by employers so they need to register for the Fringe Benefits Tax (FBT)

⦁ In case if the employee is involving into salary sacrifice arrangement with the employer so both of them need to assure that the particular arrangement is agreed by both of them and there is documentation of everything.

The declaration form shall have check marks of all the above mentioned requirements and duly signed by the employee that he/she has fulfilled all the obligations of being an employee. The copy of the declaration form shall be provided to the employee as well for his/ her record.

13. Explain the periodic deductions process within designated timelines and identify who are the nominated creditors.

The periodic deduction process is the process under which an employer withholds a certain amount form the employee’s salary. The purpose of this withholding is for various reasons, commonly the Medicare and social security. The deduction process can be based on monthly, bi-monthly or yearly basis. The deduction process shall be agreed b/w employees & Employers at the time of hiring and also reviewed from time to time after implementation of new policies and rate by State (Bird,2002).

The nominated creditors:

ATO

Other Taxation Authorities

Insurance companies

Banks/Financial institutions

14. When preparing and dispatching payments to government authorities accurately and in accordance with relevant government legislation, what are the key considerations? Please ensure you include the formula for (W5) Total Amounts Withheld as part of your response.

As all W1 till W5 are connected hence one by one they all are being briefed below

Key considerations:

W1: All the gross payments which are supposed to withhold amounts. The payments may include wages, salaries, allowances paid to office holders and labors Payments related to Employee Termination Superannuation etc

All the payments shall be excluded which fall under salary sacrifice arrangements

⦁ Super contributions.

⦁ Payments made to foreigners for the purpose of sports, fun and entertainment actions

W2: All the payments withheld at W1 shall be shown here if not then this place shall be kept empty

W3: It is inclusive of all the payments made for interest, investment portfolio contributions and dividends. All payments made which departed the country(Australia). The Payments made to foreigners for the purpose of sports, fun and entertainment actions shall be included here (Christensen,2001).

W4: all the payments made to suppliers that didn’t quote their Australian business numbers to a business so as per rules 47% of their amount which is invoiced shall be withheld and paid to Govt.

Finally, W5 refers to the total of W2+W4 and W3 (W5 excludes total of W1)

15. Describe how you would calculate and transcribe group tax amounts and make payments in accordance with taxation procedures. Ensure you provide an explanation on how to calculate PAYG withholding; the weekly tax table, and how to calculate tax offsets, FBT, HELP debt tax and financial supplement debt tax.

Variables under weekly tax table shall include salaries, allowances, wages, paid parental leaves, compensation packages, payments made for accidents and disabled people.

Irrespective of amounts PAYG is calculated with formula of Estimated tax value ÷ income instalment) * 100

HECS and Help repayments or other voluntary repayments made by a person or someone other than the employer are not tax deductable. An employer can claim tax deduction for the voluntary payments he/she make on the employee’s behalf (Harding, et al.,2006).

FBT calculation

⦁ Total of taxable value of all fringe benefits shall be compiled first which can be claimed as a GST

⦁ Grossing up of all the taxable values of fringe aids

⦁ Exclude all benefits which are claimable for a GST credit

⦁ Working to be done of all fringe benefits which aren’t claimable

⦁ Working needs to be done of all the taxable value that can’t be claimed, this stage is connected with stage 4

⦁ Multiply the aggregate fringe aids which are taxable amounts (mentioned in stage6) as per the rate of FBT.

16. What is involved in preparing and reconciling employee group certificate amounts from salary records? Be sure to include an explanation on the end of payroll year checks and processes.

The group certificates previously known as the PAYG summary.

It is to be made sure that the last Pay run has been processed already.

All the details of employees need to be updated including employee addresses, their tax file numbers and other details

The summary of profit and loss statement should match the summary of wages paid to employees during the financial year.

The salary sacrificed amount should only include the original sacrifice value and not the complete contribution of SG which is 9.5%

All the respective allowances shall be recognized in the section of Allowances in the PAYG Summary (Krishna & Slemrod,2003).

If certain employees have been terminated due to certain reasons so there must be lump sum payments to report

All the fringe benefits provided to employees need to be added up and they should exceed the amount of $2000

[citationic]