ACC5000: Accounting Applications Expert’s Solution

The course ACC5000- Accounting Application provides skill development and knowledge in order to meet accreditation requirements of Chartered Accountants Australia, Chartered Accountants New Zealand, and CPA Australia.

This assignment is designed to give you the opportunity to:

- Correctly apply accounting concepts to transactions and accounting cycles…(Course Objective 1).

- Use and apply the applications of software for preparation of financial statements (Course Objective 3).

Online Tutoring Requirements:

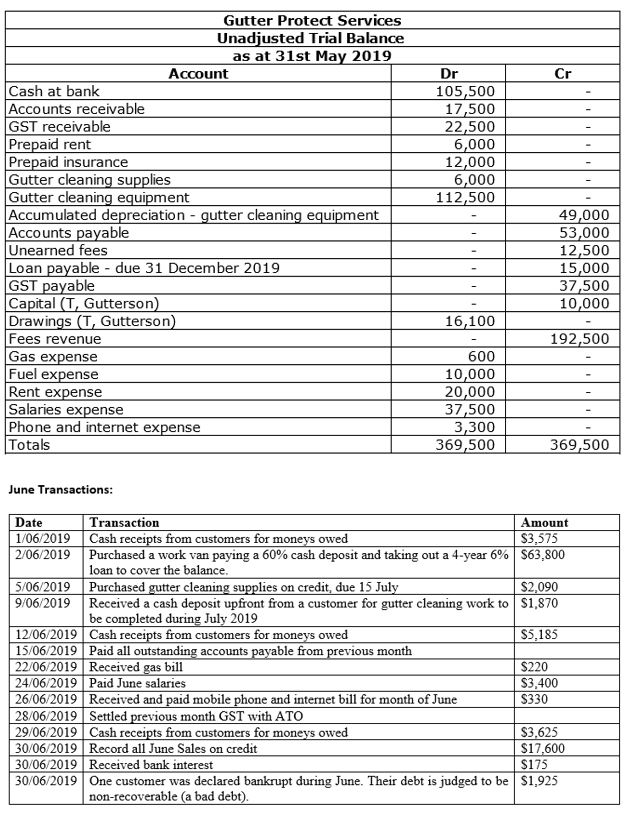

Tony Gutterson is the owner and manager of a gutter cleaning business, Gutter Protect Services. Consider the information provided for Gutter Protect Services and use Excel to:

- Record the journal entries for June transactions.

- Record adjusting entries for the end of June.

- Construct the “T” formatted ledger accounts.

- Prepare the profit and loss statement for the year ended 30 June 2019.

- Prepare the classified narrative formatted balance sheet as at 30 June 2019.

You must use formula to construct the ledger accounts, profit and loss statement, and balance sheet. The excel sheets must be linked to each other. You CANNOT just enter the data into the financial statements. You must enter the data once and link the excel sheets to produce the financial reports.

Additional Information:

- All sales are credit sales (30 days).

- Unless stated all amounts are GST inclusive or GST exempt.

- Interest expense of $105 has accrued in June on the loans payable.

- A physical count of gutter cleaning supplies on 30 June shows $950 of unused supplies on hand.

- Depreciation of the gutter cleaning equipment this year is estimated to be $25,000.

- Depreciation of the van will be determined using the straight line method. Tony estimates the useful life of the van to be 5 years, and the residual value to be $28,000. Based on these values, Tony estimates annual depreciation on the van to be $6,000 per year.

- Prepaid insurance was paid on the 1st of April 2019 and covered a period of 6 months.

- Prepaid rent balance as at 1 July 2019 should be $2,400.

- Of the unearned fees balance as at 31st May, 60% were refunded to a customer as Tony was unable to complete the work prior to 30 June as previously agreed, the remainder of the unearned fees were earned during June.

- Salaries expense accrued for the last week in June amounts to $2,800.

- The fuel expense for June of approximately $1,000 has not been recorded or paid.

- At the end of the month Tony withdrew $5,000 for his own use.

This subject uses both accounting information system and manual framework to gain understanding at how business are structured, the work and effect of these frameworks on enterprises. It merely helps to inspect business nature and its environment, also examine the principles, concepts, practice and standards of recording accounting information. This accounting application software often divides function into modules like account receivable, payable, inventory and more.

The Accounting application is based on the premise that knowledge of information systems is crucial for adding business value, creating competitive firms, giving useful services and products to customer. It’s a mandatory course in Master of Professional Accounting that utilizes accounting software in order to fulfill the core knowledge requirements of professional bodies. Moreover, the subject inspects accounting information systems role in favor of operational and strategic problems solving and decision making, as well as management and operation support.

To make successful attempts on this subject assignment, it is important to understand and apply accounting concepts to accounting cycles and transaction using both computerized and manual accounting systems. Many require critically evaluating output from an accounting information system. Moreover, it involves understanding and using the applications of software for analysis and preparation of financial statements. Giving practical hand on accounting task, often it becomes necessary to explain the need for effective governance as well as their control within accounting information system.

How Accounting professionals at myassignmenthelp can help you with your studies?

Drafting assignments of the course ACC5000 Accounting Application requires accuracy and precision. Due to insufficient time, poor subject knowledge and other certain reasons, student face difficulties in drafting assignments and have no other option than hiring an accounting expert. Often these detailed assignments seems hectic and frustrating, but for some reasons they hold great importance.

- It helps to gain in depth subject understanding.

- It develops and enhances students’ analytical skills.

- It’s an effective measure to make students’ work on time.

- Online Tutorings at specified intervals help students to revise previous learning and grasp strength on the subject with advance readings.

Concerning all these parameters, MyAssignmentHelp Australia has devoted team of writers from reputed institutions in Australia. Keeping themselves clear and with competent subject knowledge, they manage to meet students’ grade expectations. The experienced professionals for ACC5000 – Accounting Applications at myassignmenthelp are the right approach for you. They use bookkeeping data and manual system to look at how these are organized, work and its effects on enterprises. Given the task, they carefully study the organization idea and their environment, also the standards, ideas, practices and principles of chronicle bookkeeping data.

Cite This Work

To export a reference to this article please select a referencing stye below:

[citationic]